How much money will I receive in retirement?

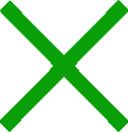

Switzerland’s pension system is based on the principle of three pillars. The first two pillars (AHV and BVG) are compulsory, while the third pillar is voluntary.

1. Pillar – AHV

The state old-Age and survivors’ insurance (AHV) forms the stable foundation of your pension.

- The maximum AHV pension is CHF 2’520 per month, or CHF 3’780 per month for married couples.

- You achieve the maximum AHV pension when contributing for 45 years at an average annual income of CHF 90'720.

2. Pillar – BVG

Occupational pension provision (BVG) complements the AHV through your pension fund.

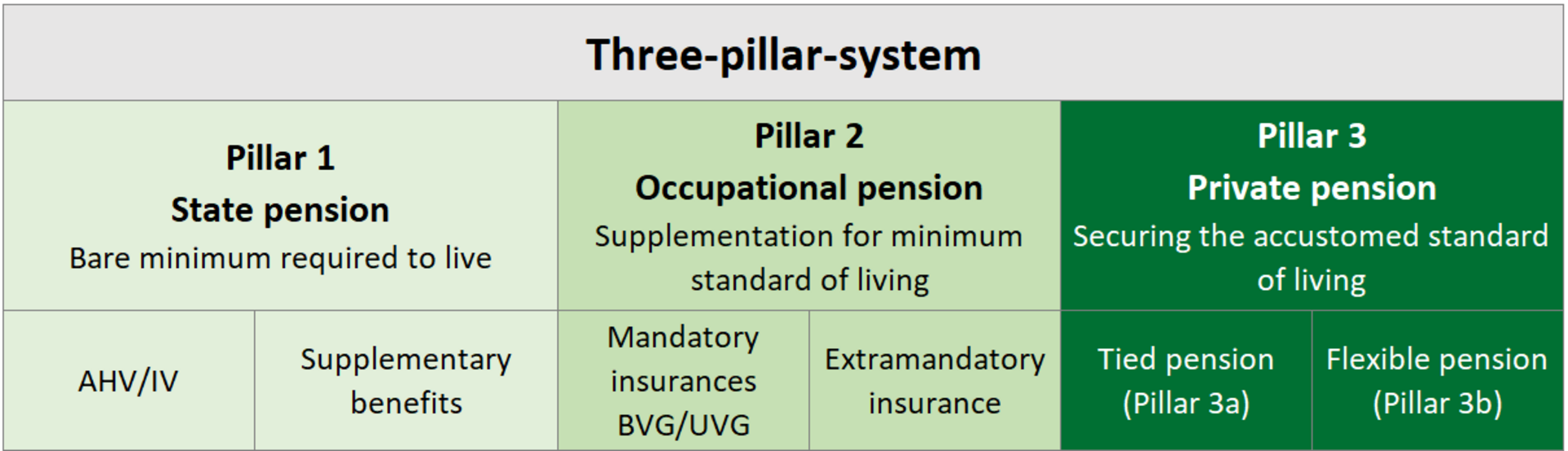

- Most people can expect a BVG pension of about 40% of their pre-retirement income.

The average income gap in the Swiss pension system has been steadily increasing for 20 years.

- Anyone just starting their career will most likely have to work longer for a smaller pension.

- Higher costs for rent, groceries, and healthcare further exacerbate this situation.

Maintaining your standard of living in retirement with the 3a pillar

Pillars 1 and 2 are designed to secure a basic level of subsistence in retirement – the 3rd pillar ensures you can maintain your accustomed standard of living. Joining the pillar 3a early on is the most effective way to close any gaps in your household budget. Your contributions can be invested in attractive stock portfolios, allowing your assets to withstand inflation.

- Annual contribution limit of CHF 7’258 for employees (as of 2025)

- Up to 20% of net annual income, max. CHF 36’288 for self-employed individuals without an occupational pension (as of 2025)

- Contributions are fully tax-deductible.

- The 3a pillar can also cover risks such as disability, thereby securing your family’s future.

We are happy personally consult you and find the right pension plan for your individual situation.

How much can I save up for retirement?

The amount of 3a pillar assets you accumulate for retirement depends on various factors – the most important are:

- Joining a 3a pillar plan as early as possible

- Contributing the full limit each year

A 3a pillar investment that achieves a strong annual return of 7% on your assets can reach the following amounts with the maximum contribution:

A 3a pillar investment that achieves a strong annual return of 7% on your assets can reach the following amounts with the maximum contribution:

- CHF 300’000 after 20 years

- CHF 685’000 after 30 years

- CHF 1'450’000 after 40 years

If the money were not invested in a 3a pillar but instead deposited in a regular bank account, you would only have saved CHF 307’967 at average interest rates after 40 years – and this amount would also be subject to wealth tax.

Our tip: Make sure to use the full contribution limit as early in the year as possible, rather than waiting until the last quarter. This way, each yearly contribution has more time to grow your assets – you could save up to CHF 20’000 more this way.

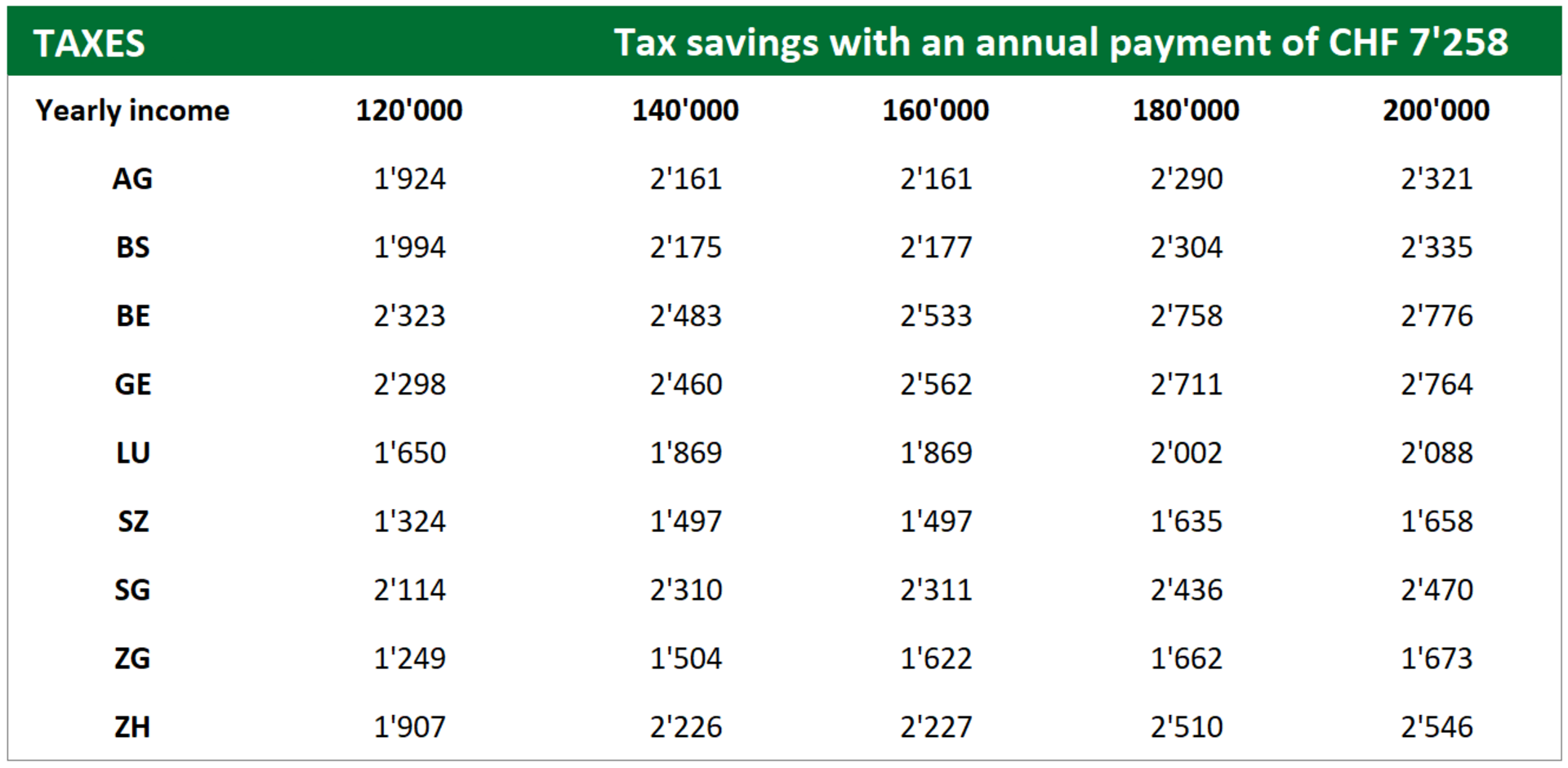

How much tax can I save with the 3rd pillar?

Contributions to the pillar 3a are fully deductible from income tax. Depending on the canton and your income, you can save up to CHF 2’800 in taxes every year thanks to the 3rd pillar.

- Over 40 years, you can already reduce your tax burden by up to CHF 112’000.

- The 3a pillar is not subject to wealth tax, providing additional savings.

The payout from the 3a pillar is taxed, but it does not count as income – the capital withdrawal tax varies from canton to canton, yet it is considerably lower than income tax (approximately 4 – 11%).

Retirement planning – the earlier, the better.

When it comes to planning for retirement, the rule is: the earlier, the better. This is the only way to benefit from long-term wealth accumulation and ensure timely coverage against death and disability.

As a next step, we recommend reviewing your pension fund statement today. This will help you understand the potential development of your assets and any income gaps that can be closed with a 3a pillar solution. Simplecare would be happy to support you – contact us now.