Is my current disability insurance enough?

Several factors determine how much money you receive through your state pension in case of disability:

- The severity of the disability

- Your previous income and pension fund

- Whether you became disabled due to illness or an accident

In general, you should expect a significantly smaller pension if you become unable to work due to illness compared to an accident. 82% of disability cases arise from illness, and only 6% from accidents, with the rest coming from existing conditions at birth. In Switzerland, more than 450'000 people receive disability benefits.

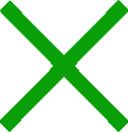

Disability due to illness

There is a significant income gap in the event of disability due to illness, because only the IV (invalidity insurance, first pillar) and pension fund (second pillar BVG) benefits apply - about 50–60% of the income is supplemented.

- The IV portion of pension can turn out to be unexpectedly low. The total monthly IV pension depends on your income but is capped at CHF 2’520. At a disability level of 40%, only 25% of this IV pension is paid out.

In the event of a serious illness, the employer’s obligation to continue paying your wages (or their daily illness allowance insurance) applies for the first two years - after that, you face the risk of an income gap.

In the event of a serious illness, the employer’s obligation to continue paying your wages (or their daily illness allowance insurance) applies for the first two years - after that, you face the risk of an income gap.

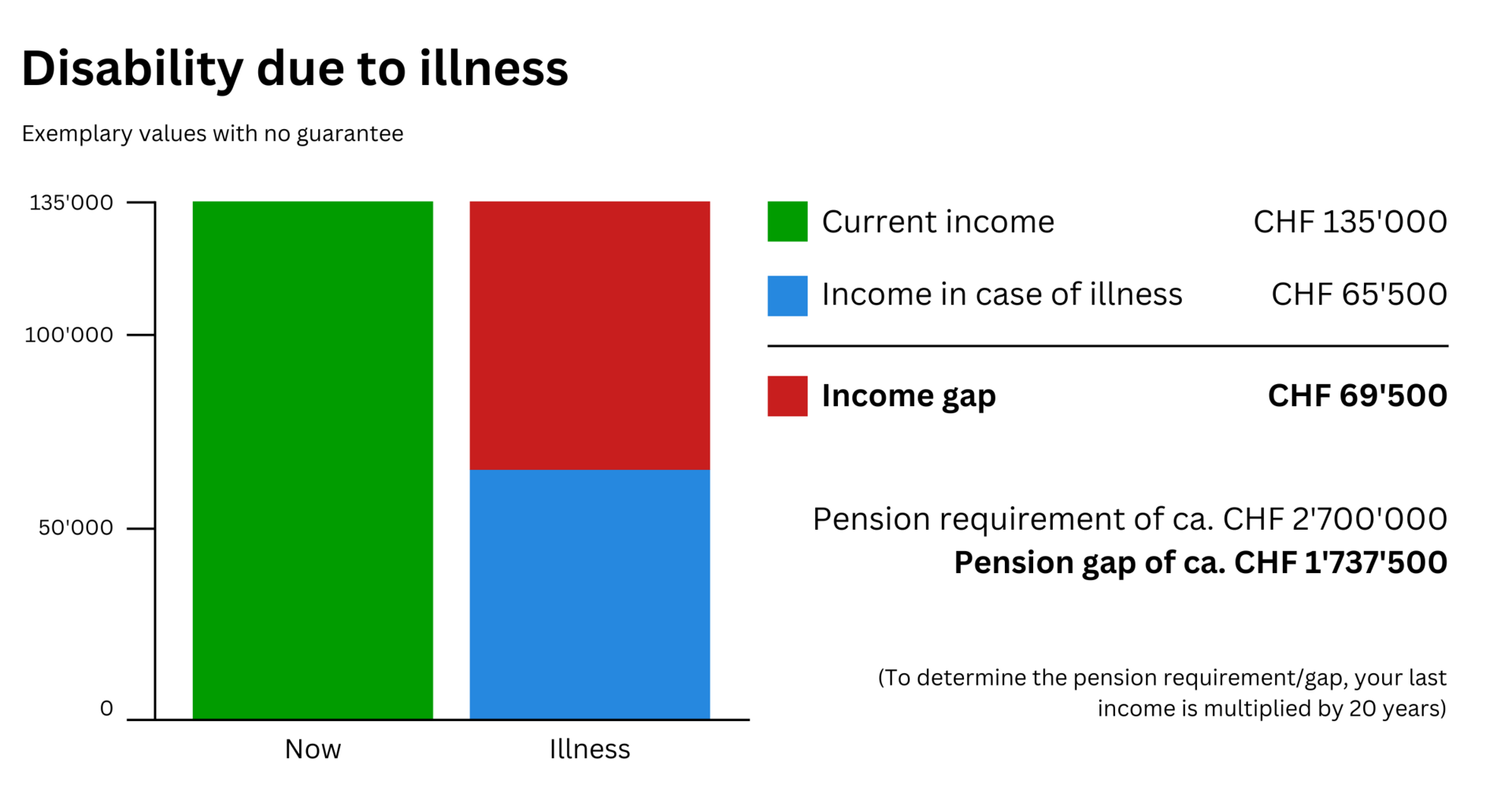

Disability due to accident

In the event of an accident, the mandatory accident insurance covers a large portion of your previous income as a pension (around 90%). If it covers less than 80% of your salary, your employer is once again required to continue wage payments.

The financial burden in the event of disability is immense. Healthcare costs rise, income drops significantly, and your contributions to the AHV and income tax remain.

The financial burden in the event of disability is immense. Healthcare costs rise, income drops significantly, and your contributions to the AHV and income tax remain.

Disability as an entrepreneur

"I'm self-employed - what happens if I can no longer work?"

- Self-employed individuals are especially at risk in case of illness or accident because they have no insurance obligations.

- Since they do not have a pension fund, they receive only basic IV (first pillar) coverage - at most CHF 30’240 per year.

It is strongly recommended that they join pillar 3a with coverage for income loss due to illness or accident. Entrepreneurs have a higher contribution limit than salaried employees - up to 20% of their annual net income, capped at CHF 36’288. This amount can be fully deducted from income tax.

A daily allowance insurance policy for owners in the event of illness or accident can also be a good option for the self-employed. We are happy to assist entrepreneurs in finding the best possible coverage for any situation - contact us today.

How can I insure my income?

To insure your income against emergencies, taking out an occupational disability insurance policy is recommended. In the event of disability, this policy pays a pension that covers the gaps in state benefits and thus maintains your standard of living. It is part of the third pillar and can be taken out through pillar 3a or 3b.

The occupational disability pension offers:

- Attractive premiums – depending on age and duration, monthly costs starting from CHF 20 can provide an additional annual pension of CHF 36’000.

- Tax advantages when taken out as part of Pillar 3a.

- Protection for your family, mortgage, and more.

The occupational disability pension can be beneficial for everyone but is especially valuable for individuals who do not pay much into their pension fund, such as stay-at-home spouses, students, part-time employees, and the self-employed.

If you would like to close your income gap in emergency situations, Simplecare is here to help. We analyze your pension fund statement, identify income gaps, and find the right pillar 3a solution for your individual circumstances. Contact us for a personal consultation with our pension experts.