1st pillar – Survivor’s pension

From the 1st pillar of the pension system, a survivors’ pension will be paid out after your death - specifically a widow’s, widower’s, or orphan’s pension.

- The widow’s/widower’s pension amounts to a maximum of only CHF 2’016 per month and is reduced for most people due to numerous conditions related to marital status and length of marriage.

- The orphan's pension is half that amount and ceases after the child turns 18 (or 25, if the child is still doing work-related education/training).

2nd pillar – Occupational pension

From the 2nd pillar, the occupational pension also pays out a grant to spouse and children in the event of your death. The amount of this pension depends on your income and the conditions of the pension fund, which is why it can vary greatly from person to person.

- With a spouse’s pension, you can generally expect 30-50% of your most recently insured income over the entire period.

- The orphan's pension is usually between 8-14% of the last insured income.

- If there are no survivors entitled to compensation, a lump-sum death capital may be paid out depending on the pension fund. This can go to a person named in a beneficiary declaration (e.g. adult children).

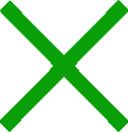

Even with state pension payments, there remains a significant shortfall. Losing half of one’s previous income can seriously jeopardize the future of your loved ones.

Even with state pension payments, there remains a significant shortfall. Losing half of one’s previous income can seriously jeopardize the future of your loved ones.

Death during self-employment

If you work as a self-employed entrepreneur, you are not subject to the same insurance requirements as an employee – you only have to pay AHV contributions, and no contributions to the second pillar (pension fund and accident insurance).

This means that in the event of death, your surviving dependents will not receive a pension from the pension fund. They would only receive a survivor’s pension from the 1st pillar, which leaves them at a significantly higher risk of poverty.

To compensate for this gap in coverage, self-employed individuals have a higher contribution limit to the pillar 3a than employees – up to 20% of net income, with a maximum of CHF 36'288:

3rd pillar – Our life insurance offering

A voluntary life insurance policy is ideal to guarantee, for example, the ongoing payments on a mortgage. Term life insurance policies are offered in Switzerland as part of the 3rd pillar, and they pay out a lump sum to survivors in the event of death during the contract term. This protects them from the risk of insolvency and helps them cope with rising living costs.

- If the life insurance is part of pillar 3a, all annual premiums can be deducted from your taxes.

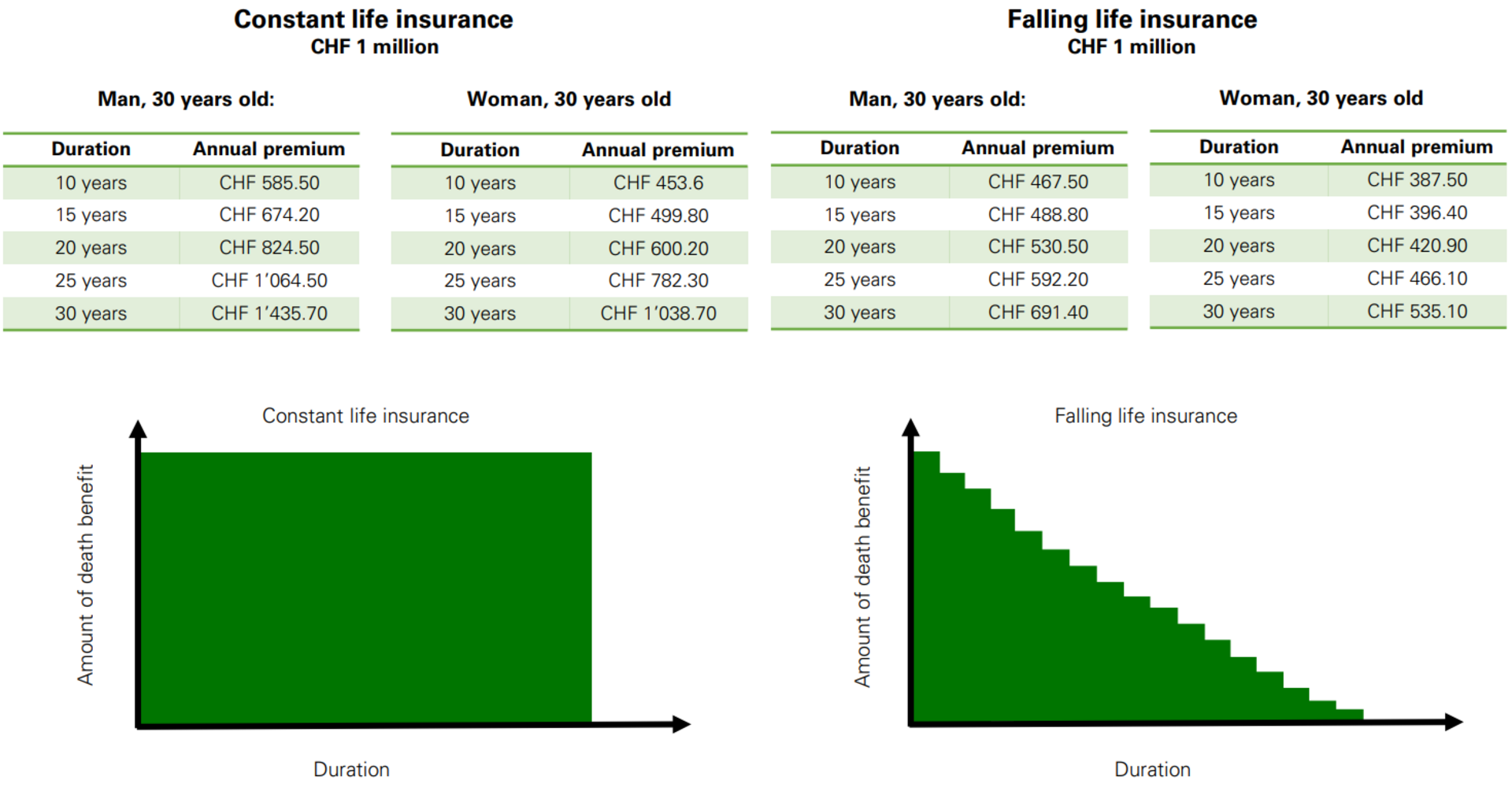

- A constant life insurance policy is suitable for general financial protection in the event of death.

- A falling life insurance policy will pay out less capital over time but also has lower annual premiums - this is suitable, for example, if there is an ongoing mortgage to consider.

Roughly calculated annual premiums for a life insurance policy with a payout of CHF 1 million, depending on duration and type:

There are various types of life insurance:

- Risk life insurance: If death does not occur during the contract term, there is no payout. It can also cover the risk of disability.

- Savings life insurance / combined life insurance: This includes a typical savings component in addition to death coverage. Assets are built up and paid out at the end of the term, regardless of whether death has occurred or not.

If you would like to secure your loved ones’ well-being now, Simplecare is here to help. We analyze your pension fund statement and advise on financial risks that can be covered by life insurance solutions tailored to you. Contact us for a personal consultation with our retirement planning experts.