How do I insure my household correctly?

If you have just moved to Switzerland, you may want to get a household insurance policy. This coverage reimburses the value of your personal belongings if they’re ever damaged or stolen.

To take out household insurance, you need to tell your insurance provider about the total value of all your belongings, so they can confirm the premium cost and maximum insured sum of your coverage. This includes:

- Your furniture and decorations

- Electronics like phones, stereo systems, and computers

- Equipment relating to hobbies

- The belongings of your children

- Everything you keep in your garden, basement, or attic

You can generally assume that all your moveable goods, apart from exceptional valuables and cars, are covered. You can use a rough estimation value, like CHF 65’000 for 2 people in a 2.5-room apartment, or CHF 90’000 for 2 adults and 1 child in a 3.5 room apartment as a starting point.

But be careful - you need to enter the replacement value of your household (as in the price of an item when it was new). If you fail to do this, you will be at the risk of underinsurance.

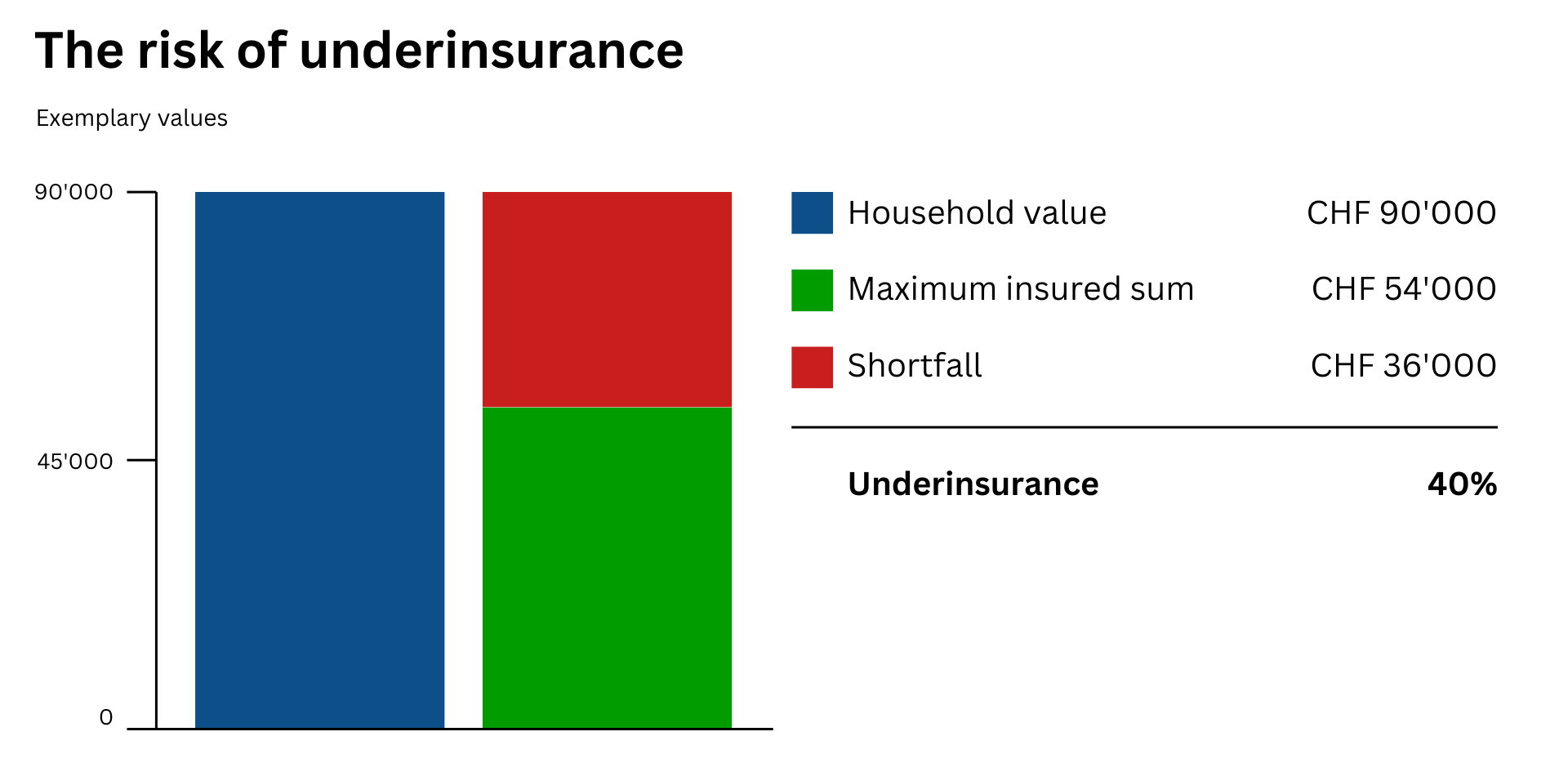

Underinsurance example:

Let’s take a look at an example where your total household is worth CHF 90’000 (new price value), but you insured only CHF 54’000. In this case your household is underinsured by 40%.

Underinsurance is a serious financial threat because it even affects damage that doesn’t max out your insured sum. In the case of a claim, for example a theft at home of CHF 20’000, you would only be reimbursed for 60% (CHF 12’000) of the damage, leaving you with costs of CHF 8’000.

- Your insurer is obligated by law to apply this coverage deduction if the damage is caused by a natural hazard. Under different circumstances, they may choose to forgo that and reimburse all damages.

How can I avoid underinsurance?

Underinsurance is not to be underestimated – and in the case of a burglary, fire or water damage, the last thing you need to deal with is insufficient coverage. Follow these steps to avoid underinsurance:

- When calculating the insurance sum, enter everything at its replacement value.

- Keep receipts for noteworthy purchases.

- Make sure to adjust your coverage after expanding your household.

- Jewelry is usually only covered to about CHF 30’000. It’s worth getting a separate valuables coverage for items that exceed this amount.

I’m new in Switzerland – do foreigners need household insurance?

There is no federal* law that requires you to insure your household, but it is highly recommended. Not only is the coverage generally quite affordable, it’s also an essential safety measure for your new home in Switzerland. Note that normal wear-and-tear/maintenance costs are not covered. Your insurer will inform you about any other exceptions.

*There are a few cantonal exceptions where household, liability and building insurance is mandatory:

Household:

- You are required to insure your household in the cantons of Freiburg, Jura, Nidwalden, and Vaud against fire and elementary damage.

- The cantonal fire/elementary insurance is required for Nidwalden and Vaud, while you’re free to choose your insurer in Freiburg and Jura.

Liability:

- Personal liability insurance is generally voluntary, although landlords may require you to have it for rental agreements

- Dog owners are required to have liability insurance in most cantons

- Liability insurance is necessary for any motor vehicles in all of Switzerland, as well for E-bikes that reach speeds above 25 km/h

Buildings:

- Property owners need to insure buildings against fire and elemental damage with their cantonal building insurance

- An exception to this are the GUSTAVO-cantons, where building insurance is only possible through private insurers (Geneva, Uri, Schwyz, Ticino, Appenzell Innerrhoden, Valais, Obwalden).

- There is no building insurance requirement at all in Geneva, Valais, Ticino, and Appenzell Innerrhoden

What kind of damage is insured by household insurance?

Household insurance covers you from every angle. There are a few differences based on your provider, but almost any damage scenario is insured:

- Your household is damaged at home by a fire or water

- Natural hazards like floods or storms damage your possessions

- Your possessions were stolen in a burglary

- You damage one of your belongings by accident, like dropping your phone or spilling wine on an expensive carpet

- Glass breakage of windows, toilets and sinks, as well as furniture made of glass

- And more

Do I need valuables insurance?

Most household policies don’t cover single objects that exceed a value of CHF 30’000. So if you’re keeping individual high-value items in your home, like jewelry or artwork, then you might want to consider getting additional valuables insurance. In this case your valuables are insured against any damages (all-risk) including loss or damage.

Household insurance for foreigners

Simplecare is here to help you find the best coverage for your new home in Switzerland, as well as for healthcare, private liability, and more. Contact us today to talk to our independent insurance experts and compare offers.